generate a new title here, between 50 to 60 characters long

Written on

Chapter 1: The Tech Stock Resurgence

In stark contrast to 2022, 2023 has seen technology stocks leading a significant market rebound. The burning question is: how long can this trend persist?

This paragraph will result in an indented block of text, typically used for quoting other text.

Section 1.1: Performance Overview

The major tech players have reported impressive year-to-date (YTD) gains:

- AAPL: Up 40%

- MSFT: Up 39%

- GOOGL: Up 39%

- AMZN: Up 40%

- META: Up 110%

- NVDA: Up 172%

These stocks have greatly outperformed the S&P 500, which has risen by 10% in 2023. After a dismal 2022, where most faced losses exceeding 30%, many of these companies are now approaching record highs.

Subsection 1.1.1: Factors Behind the Tech Boom

The primary issues that dominated financial headlines last year were inflation and interest rates. While these were significant challenges in 2022, they have largely been mitigated in 2023. Inflation peaked at 9.1% in mid-2022 but has since decreased to 4.9%. This drop, while still above the Federal Reserve's target, signals improvement and growing confidence in economic stability.

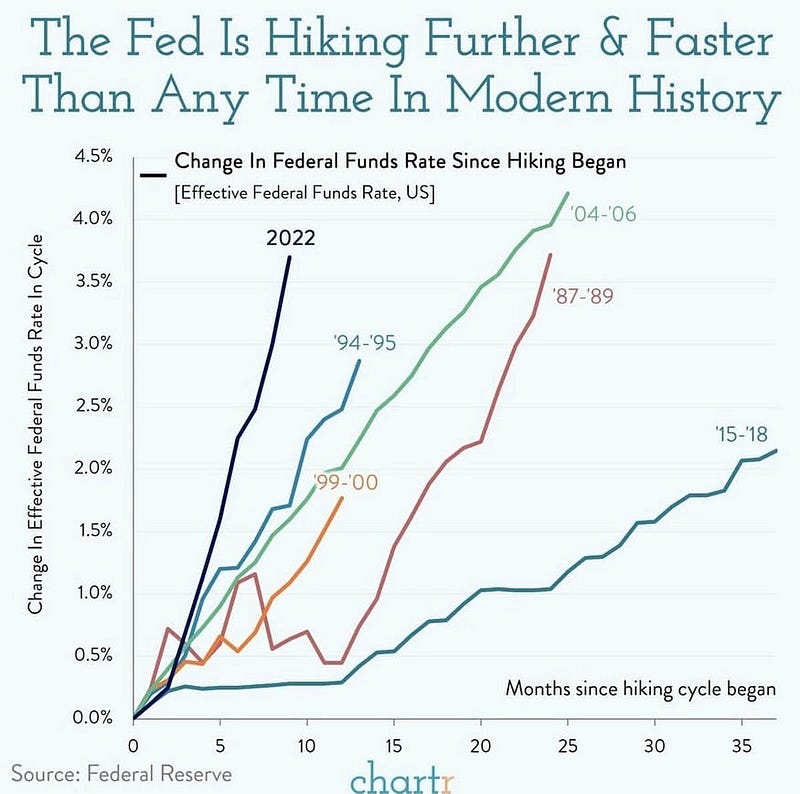

In response to soaring inflation, the Federal Reserve shifted away from quantitative easing and began raising interest rates, starting with a modest 0.25% increase in March 2022. This eventually escalated into four consecutive hikes of 0.75%, resulting in the highest rates seen in 15 years.

Such rapid and substantial increases unsettled investors, especially as high interest rates usually hinder tech stocks due to rising debt costs. However, as inflation has come under control, market sentiment has shifted, with expectations that the Fed's rate hikes may soon be concluded or limited to a single additional increase of 0.25%.

Section 1.2: The AI Factor

A significant catalyst for the tech stock surge has been the remarkable rise of artificial intelligence (AI). This trend has led to a heightened investor interest, with many willing to pay premium prices for stocks in this sector. Nvidia has emerged as a notable beneficiary, being the leading chip manufacturer essential for AI technologies.

Chapter 2: A Closer Look at Key Players

In the video titled "Why the Stock Market Will Keep Rallying in 2024," experts discuss the future of the stock market and the continuing influence of technology.

What's particularly intriguing is that the four dominant companies—AAPL, MSFT, AMZN, and GOOGL—are all experiencing similar growth rates. However, the standout performers are Meta and Nvidia.

Meta faced a challenging 2022, with substantial employee layoffs and scrutiny towards CEO Mark Zuckerberg. Yet, they have seen a remarkable recovery, outpacing many of their peers in the tech space.

Nvidia has been the highlight of 2023, capitalizing on the AI frenzy. Following a strong earnings report, Nvidia's stock surged by 24% on a single Thursday, bringing them closer to joining the coveted trillion-dollar valuation club.

In the video "Bull market in stocks will extend well beyond 2024," Virtus' Joe Terranova shares insights on the sustainability of the current bull market and its implications for the tech sector.

Section 2.1: Looking Ahead

While 2022 was characterized by a boom in energy stocks, 2023 has been dominated by technology. The future remains unpredictable, as it will take time to determine whether AI will deliver the expected revenue growth for companies like Nvidia. Moreover, the Federal Reserve's actions concerning interest rates will continue to influence the tech market.

As we assess the latter part of 2023, it is important to note that current valuations are relatively high. After such significant gains, one must ponder how much further tech stocks can rise.