# Engaging with 'Boring' Financial Topics for Personal Growth

Written on

Chapter 1: Finding Joy in Financial Discussions

Understanding and managing your cash flow is essential for solid personal finance, and tracking it is the first step towards achieving that.

By Jesse Cramer

Until 2017, I couldn’t pronounce "Les Miserables." Now, I can sing along to all the songs! My wife surprised me with tickets for my birthday, and it was an incredible experience. Interestingly, while most children tend to dislike activities like visiting art museums or watching musicals, many adults find value and beauty in these experiences.

A similar transformation occurs in the realm of personal finance. Initially, we might find managing money tedious, but that excitement can fade once we’ve mastered it. It’s common for people to become enamored with their financial progress for a while, but as things stabilize, the thrill diminishes.

However, there’s no need to feel disheartened. The absence of excitement in your finances often indicates that you’re on the right track.

I continue to discover fascinating aspects of finance, especially within areas that are typically viewed as dull. Let me share a few of these topics that might pique your interest as well.

Section 1.1: Embracing Taxation

Is there anything more tedious than taxes?

Surprisingly, I find tax matters quite engaging. Over the past two years, I’ve come to see the tax code as a complex puzzle and a game, which I thoroughly enjoy.

The rules of taxation are numerous and clearly defined. While I may not know every rule, each one I learn enhances my strategic approach. The intricacies of tax scenarios can be quite captivating—especially for retirees or business owners, where the stakes are higher and the interactions more complex.

It’s crucial to work with a knowledgeable tax professional who understands the nuances of the tax code. They can help you navigate the complexities and optimize your tax situation without crossing ethical lines.

Pro Tip: This year, take time to review your Federal Tax Return line-by-line. If something confuses you, look it up!

Getting Over the Boring Money Talk - YouTube

This video explores how to make financial discussions more engaging and less daunting.

Section 1.2: The Importance of Long-Term Investing

The Best Interest emphasizes the significance of long-term investing, which is not about quick gains but rather measured in decades.

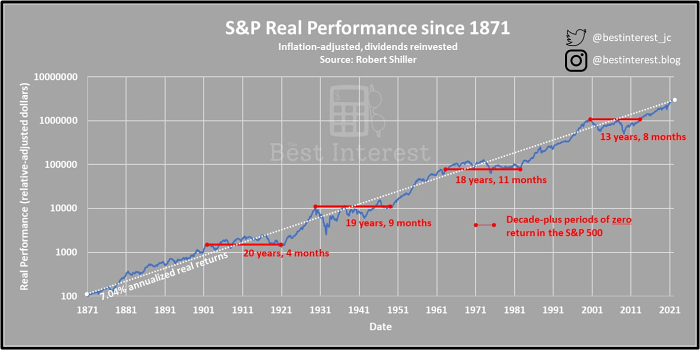

The principles of “buy and hold” and “diversify” may seem dull, but understanding market history can add excitement.

For instance, there have been historical periods where investors saw no returns for decades. The reality is that returns can be unpredictable, and inflation can eat away at your gains.

Being aware of these long-term dynamics is essential for any investor.

The lesson here is clear: expect periods of negative returns, which might last longer than you anticipate.

Note: This analysis focuses on lump-sum investments. Dollar-cost averaging can help mitigate the impact of market volatility, making it a valuable strategy.

Stop Making Boring Financial Goals - YouTube

This video encourages viewers to set engaging and fulfilling financial goals instead of mundane ones.

Chapter 2: The Foundation of Personal Finance

Understanding cash flow is fundamental to personal finance.

While it may seem basic and unexciting, cash flow management is critical.

Section 2.1: Preparing for the Unexpected

Just like in extreme sports, where ensuring safety is paramount, personal finance requires a proactive approach to risk management.

Consider essential protections such as:

- Emergency funds

- Life insurance (term only)

- Home and auto insurance

- Disability insurance

- Umbrella insurance policies

Asking yourself “What if…?” can lead to essential preparations that safeguard your financial future.

If everything in your financial life feels uneventful, celebrate that achievement. You’ve successfully navigated the complexities of finance and can now focus on enjoying life.

Conclusion: It’s Time to Live Fully

While diving deep into financial topics can be enriching, don’t forget to step back and savor life’s experiences. Whether it’s attending a musical or exploring a new hobby, there’s always more to discover beyond personal finance.

For additional insights, check out more articles from The Good Men Project on Medium, where you can find valuable advice for personal development and relationships.