Exploring Financial Habits: A Comparative Analysis of Men and Women

Written on

Chapter 1: Understanding Spending Patterns

In the ongoing discussion about financial behaviors, the differences between men and women in spending and investing are intriguing. Drawing from various studies conducted by organizations like the Bureau of Labor Statistics and Fidelity, the insights reveal not only spending habits but also the psychology behind these choices.

I anticipate that this topic may spark some lively debates in the comments! My fascination with the psychology of spending and the variations in financial habits across different demographics, including gender, is something I believe many readers share.

The Bureau of Labor Statistics examined the spending behaviors of single men and women, and the findings were quite revealing:

- Overall Spending: Single men tend to outspend women, averaging $35,018 annually compared to women's $33,786, although it is noted that men generally earn about $10,000 more.

- Food Expenses: In terms of food, single men again spent more, with an annual food bill of $4,173 versus $3,680 for women. Notably, men also spent significantly more on alcohol—$537 compared to women's $234.

- Clothing: Women lead the way in this category, with an average expenditure of $1,140, while men spent $813.

- Transportation: Men also spent more on personal transportation, averaging $5,507 compared to women's $4,273.

- Entertainment: Spending on entertainment was similar between genders, yet the allocation varied. Men invested $835 on audio/visual equipment, whereas women spent $725 on home entertainment and prioritized pets with $488.

Interestingly, women seem to excel at finding bargains. According to PaymentSense, 71% of women reported that their last online purchase was on sale, compared to only 57% of men. Additionally, a report by CouponFollow indicated that 74% of millennial women actively seek out coupons when shopping online, in contrast to 65% of their male counterparts.

Section 1.1: Debt Dynamics

When analyzing overall debt, men carry an average of $18,533—or 21.7%—more debt than women, according to Experian. The exception here is student loans, where women typically owe more than men, with an average debt of $36,131, which is $943 more than men.

Historical Note: Before the enactment of the Equal Credit Opportunity Act in 1974, women faced legal barriers requiring them to have male cosigners for loans or to make larger down payments compared to men with similar credit histories. Fortunately, significant progress has been made since then, allowing women to secure mortgages independently.

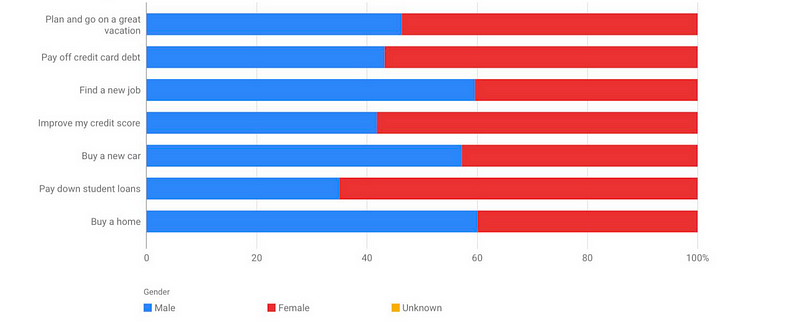

Subsection 1.1.1: Financial Goals

A study by The Motley Fool explored the top financial aspirations of men and women. The findings suggest that saving for a vacation tops the list, followed by paying off credit card debt and improving credit scores. Interestingly, women showed a slight preference for focusing on credit card debt repayment over vacation savings.

Chapter 2: Saving and Investing Trends

Despite men generally earning more, a survey by BlackRock highlighted that American women nearing retirement have an average of $81,300 saved, compared to $118,400 for men. However, women contribute a higher percentage of their earnings to retirement plans, with a recent Vanguard study showing that they contribute 8% more than their male peers.

Men VS. Women: Who Handles Money Better? - A deep dive into financial management strategies and outcomes.

Interestingly, Fidelity's research found that over half of women tend to leave their savings in cash rather than investing. However, those who do invest often outperform their male counterparts, earning up to 1% more on average. This could be attributed to men taking riskier investment approaches, while women generally prefer a more steady strategy, resulting in fewer trades and a more stable return.

Are Women Better With Money? - Exploring gender differences in financial decision-making.

Key Takeaways:

Men should consider adopting a more strategic approach to investing rather than speculative tactics. On the other hand, women are encouraged to negotiate for better salaries and seek financial aid opportunities to improve their financial standings.

This article is intended for informational and entertainment purposes only and should not be construed as financial or legal advice. Please consult a financial professional for significant financial decisions.