Better Investments: Six Alternatives to Keeping Cash in the Bank

Written on

Chapter 1: Rethinking Cash Savings

As a knowledgeable investor and financial strategist, I am here to challenge a widespread belief about banking: the notion that your savings significantly grow in a traditional bank account.

When it comes to safeguarding and enhancing wealth, it's crucial to recognize that maintaining large amounts of cash in a bank account may not be the best approach, especially in an era where inflation often surpasses the interest earned. Although your account balance might rise due to interest, this increase frequently fails to match inflation rates.

To further explore the nuances of wealth management:

Escaping the Rat Race: What School Failed to Teach You About Money

In 2003, renowned boxer Mike Tyson faced bankruptcy with a shocking debt of $30 million.

As a seasoned investor and financial consultant, I encourage you to consider a variety of assets that provide better protection against inflation and the potential for greater returns. Here’s an in-depth look at six assets that can be safer and more advantageous than cash held in a bank:

Section 1.1: Precious Metals (Gold, Silver, Platinum)

Precious metals have historically served as a refuge for investors, particularly during economic instability and periods of high inflation. Unlike fiat currencies, which can lose value due to excessive printing, metals like gold, silver, and platinum are limited in supply and possess intrinsic worth. You can invest in these metals through direct purchases or, more conveniently, through Gold ETFs, which mirror the price of gold without the need for physical storage.

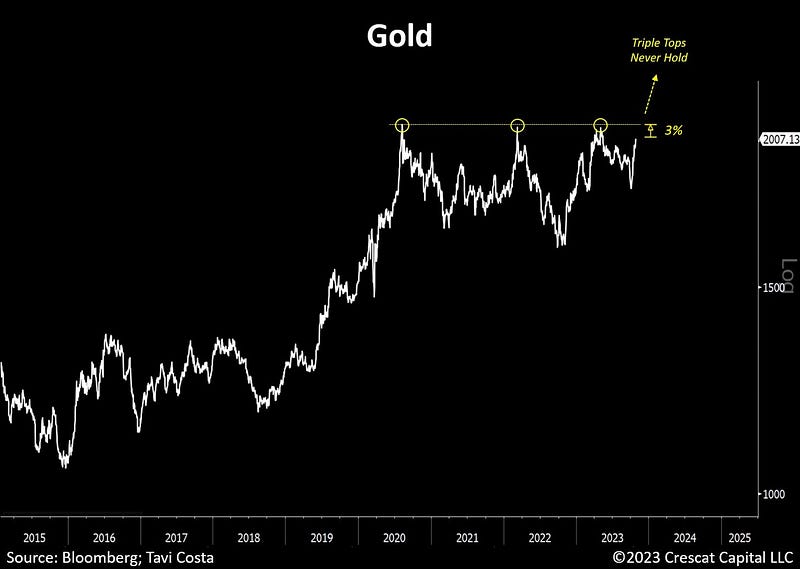

Gold is poised for a significant upward trend!

Historical Stability: Precious metals have consistently been a reliable store of value, particularly in times of economic distress and inflation. Their scarcity protects them from devaluation caused by government actions like excessive currency printing.

Investment Methods: You can invest in physical gold, silver, or platinum, but this requires secure storage. Alternatively, Gold ETFs (Exchange-Traded Funds) or mining company stocks offer exposure without the need to physically hold the metal.

Section 1.2: Industrial Commodities (Cobalt, Nickel, Copper)

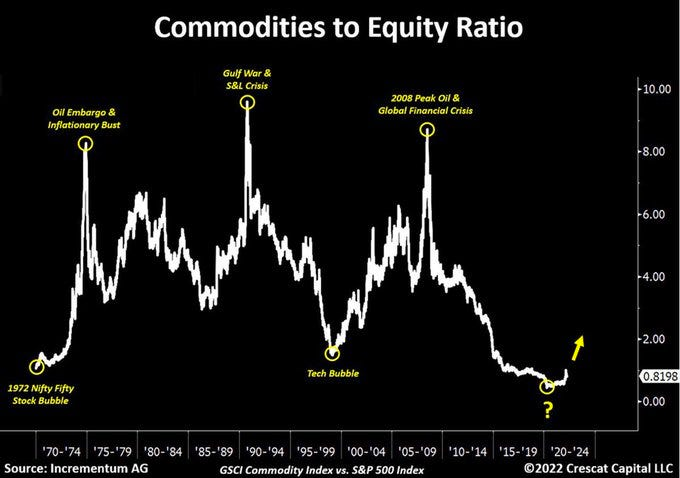

The demand for industrial commodities, critical in various manufacturing and technology sectors, tends to increase over time. Investing in commodities like cobalt, which is essential for electric vehicle batteries, or copper, vital for electrical wiring, can be a strategic decision. Instead of acquiring physical commodities, consider investing in mining company stocks or mutual funds focused on commodities.

Rising Demand: The industrial need for these commodities, especially in emerging sectors like electric vehicles and renewable energy, makes them compelling investment choices.

Investment Options: Direct investment in physical commodities can pose challenges due to storage and liquidity issues. However, mining stocks, commodities-focused mutual funds, or futures contracts can offer exposure with greater convenience.

Chapter 2: Currency and Stocks

Section 2.1: Safe Haven Currency (Swiss Franc)

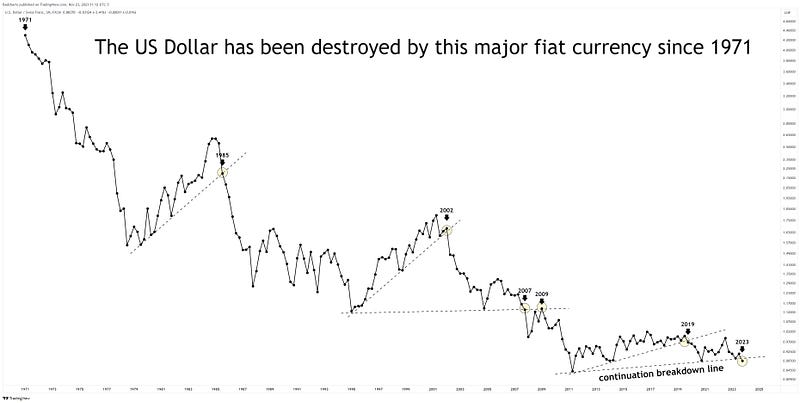

In a fluctuating global economy, certain currencies like the Swiss Franc stand out as stable investments. Supported by solid, stable economies, they can serve as a hedge against currency depreciation in your home country. Access to these currencies can be gained through Forex trading platforms or currency ETFs.

Economic Stability: During global financial uncertainties, currencies tied to stable economies become increasingly attractive. They provide protection against local currency devaluation.

Investing Mechanisms: Forex trading platforms and currency ETFs make it easy to invest in these currencies, allowing for portfolio diversification and protection against domestic currency inflation.

Section 2.2: Value Stocks and Dividend-Focused Mutual Funds

While stocks can be volatile, value stocks—those with solid fundamentals and consistent earnings—are generally less risky and often yield steady dividends. For those lacking the time or expertise to analyze individual stocks, dividend-focused mutual funds present an excellent alternative.

Stable Returns: Value stocks represent companies deemed undervalued relative to their fundamentals and usually provide reliable dividends.

Mutual Funds: For individuals who prefer not to select stocks individually, dividend-focused mutual funds or ETFs offer diversified exposure to a collection of value stocks, mitigating the risks linked to individual stock selection.

Section 2.3: Land and Real Estate Investments

Real estate is often viewed as a strong hedge against inflation. Property values typically increase over time, and real estate can also generate rental income. For smaller investors, Real Estate Investment Trusts (REITs) provide an opportunity to invest in real estate without the need to own physical properties.

Tangible Assets: Real estate and land are physical assets that have historically appreciated in value and can also produce rental income, offering both capital growth and cash flow.

REITs and Crowdfunding: REITs allow for investment in real estate without direct ownership, while real estate crowdfunding platforms enable individuals to invest in property with lower capital requirements.

Section 2.4: Collectibles (Vintage Cars, Art, Luxury Items)

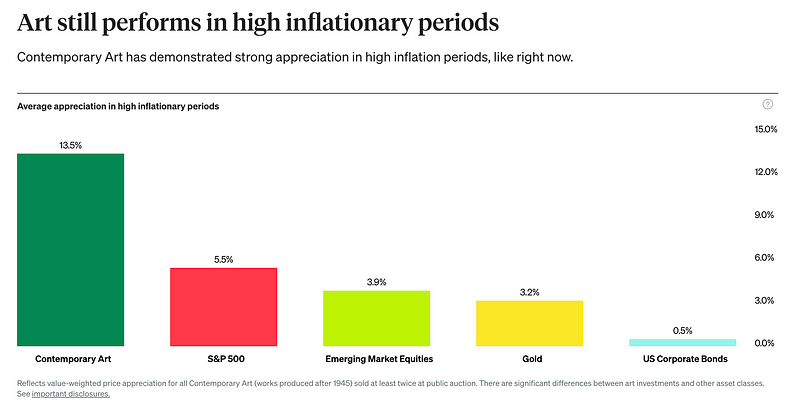

Investing in collectibles like vintage cars, art, and rare luxury items can also yield substantial returns. These assets often appreciate in value, particularly if they are unique or hold historical significance. For the average investor, platforms offering fractional ownership in collectibles can provide an accessible entry point.

Unique Value: Collectibles such as art, vintage cars, and luxury watches can grow in value, especially if they are rare or historically significant.

Accessible Investing: For those unable to invest in high-value collectibles outright, online platforms offer fractional ownership or shares in these assets.

In Conclusion

Diversifying your investment portfolio with a mix of precious metals, commodities, safe haven currencies, value stocks, real estate, and collectibles offers a robust defense against inflation and economic fluctuations compared to merely holding cash in a bank. Each of these asset classes presents its own risk and reward dynamics, so it’s essential to conduct thorough research and evaluate your financial objectives, risk tolerance, and investment timeline before making any decisions.

Sincerely,

The Pareto Investor

My book “The Little Principle That Beats the Market” is a must-read for anyone looking to invest smarter and more effectively.

Explore the insights behind why keeping cash in the bank may not be the best strategy, and discover six assets that can outperform traditional savings.

Gain a deeper understanding of safer and more lucrative investment alternatives with Robert Kiyosaki's insights on financial strategies.